Change an expense or liability account associated with a payroll item in QuickBooks Desktop Payroll

This will help you keep track of your payroll details and history, especially at year ends. First, I want to make sure your QuickBooks company file gets the full functionality of payroll updates. I need to adjust some payroll liabilities to zero for some payroll in 2019. Still, if you are confused about payroll adjustment and how to edit them in QuickBooks Online, then you can connect with industry experts like us. Paying payroll liabilities through ACH is unavailable within the program, IPTacctg.

Reasons To Use Payroll Liability Adjustment

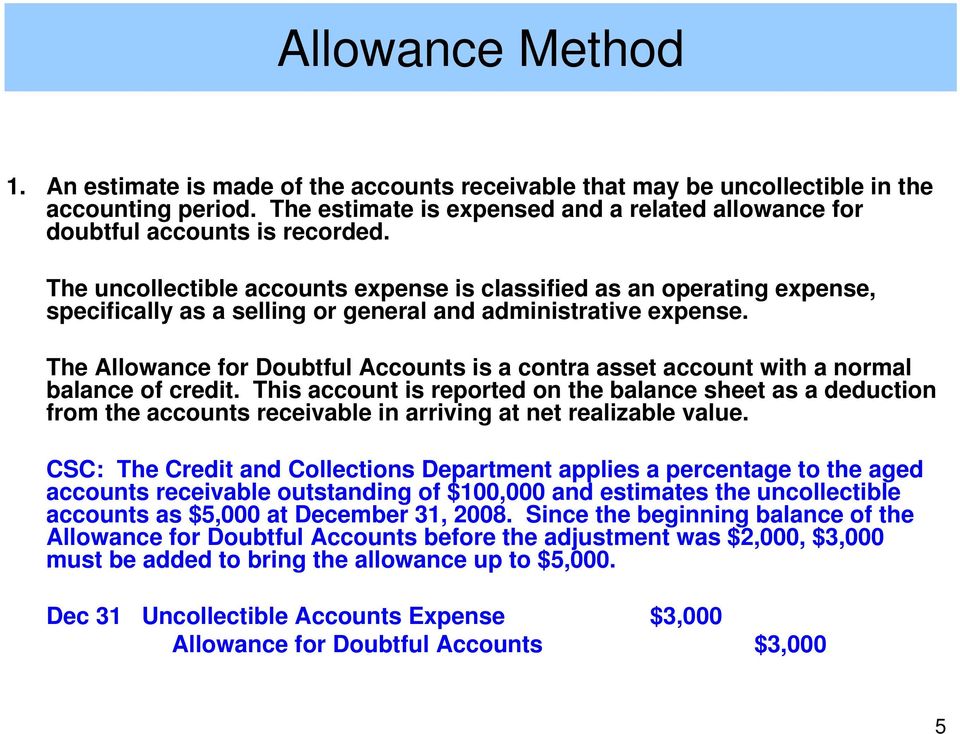

Once done, we can now create liability adjustments to zero for some payroll in 2019. Now that you understand the process of adjusting liabilities through the Payroll Center, you can proceed confidently with making any necessary adjustments to your payroll liabilities in QuickBooks Online. When companies wish to make changes in year-to-date or quarter-to-date of the employee, then the right payroll adjustment is important.

- According to this article, Recording payroll transactions manually, you may use either the Expense or Liability account when creating a Journal Entry (for payroll transactions).

- This option provides a straightforward and user-friendly way to make adjustments quickly and accurately.

- You can use only one effective date for a liability adjustment.

- You can generate payroll liability reports or review the individual liabilities in your Chart of Accounts to confirm that the adjustments have been applied correctly.

Step 2: Create Transaction Labels to Separate Employee & Employer Payroll Liability Transactions

It is impossible to adjust overpaid payroll liabilities in these versions by users themselves and thus requires an expert to fix it. Call our experts at Asquare Cloud Hosting Helpline Number, and they will help you fix the issue. Payroll liabilities adjustment will bring in a permanent change in your company file, and thus it becomes important to create a backup as you should have a copy of your current file if you need it in the future. Under the Memo field, type a short note explaining the adjustment for future reference. Throughout her career, Heather has worked to help hundreds of small business owners in managing many aspects of their business, from bookkeeping to accounting to HR. Before joining Fit Small Business, Heather was the Payroll/HRS Manager for a top cloud accounting firm in the industry.

How To Set Up Direct Deposit In Quickbooks Desktop

Any funds that aren’t routinely cleared from your payroll accounts, like retirement benefit premiums that are paid out monthly, indicate there may be a problem. For instance, a bill payment may be how to prepare a statement of stockholders equity late, or a transaction could be booked to the wrong account(s). Assume that a restaurant owes workers $3,000 in payroll for the last five days of March and that the next payroll date is April 5.

Introduction to X-Torrent: The Future of P2P File Sharing

The steps provided by my colleagues are how to address a scenario if payments were never recorded in QuickBooks. If you use QuickBooks Desktop Payroll Assisted, contact us if you need to make an adjustment for a previously filed tax form or payment. You may want to view and print payroll reports on QuickBooks Desktop.

More than likely if the Period dates cross from one year to the next, you will most likely need to edit the paid through dates to be within the year the paychecks are dated. Edit the date range of the Liability Period on the check to cover both payroll reporting periods . Date the transaction to be the same date as the payment that was already entered. We’ll show you how to change a payroll item’s expense or liability account.

When payroll is processed on April 5, cash is reduced by $3,000 and wages payable is decreased by $3,000. The expense was posted in March when the restaurant employees worked https://www.personal-accounting.org/accounting-basics-for-entrepreneurs/ the hours. Revenue in March is matched with March expenses, including the $3,000 in payroll costs. To fix this problem, you’ll need to identify why it began occurring.

You may do this annually, but doing it monthly saves more time in the long run. It is essential to review the adjustments made in the Chart of Accounts to confirm their accuracy. You can generate payroll liability reports or review the individual liability accounts to ensure that the adjustments align with your requirements. This process involves carefully examining each employee’s pay rate, deductions, benefits, and any other relevant information to ensure that their records are updated with the correct information. Reconciling any discrepancies between the adjusted liabilities and the original records is essential to maintain accurate financial reporting.

Please note that adjusting payroll liabilities should be done with caution, as it can have a direct impact on your financial statements and tax reporting. It is recommended to consult with a professional bookkeeper or accountant if you are unsure about the adjustments you need to make. Last night I discovered that one of my biggest issues is that Payroll has been recording the paychecks in the “Operating (233)” register. (I fixed this in payroll settings) Anyway, I thought, ok I’ll just edit the paychecks. Since they were DD, the only way to change the acct is to void the check.

If you need to make adjustments for more than one period, then you must use a separate adjustment transaction for each period. Make sure that the adjustments are correct by selecting the appropriate reports when finished. https://www.adprun.net/ This recalibration process involves carefully reviewing the previous calculations, identifying any discrepancies or errors, and then correcting these figures to reflect the accurate tax withholdings and liabilities.

Adjusting employer contribution parameters, such as retirement plans or health benefits, should be carefully assessed to align with company policies and employee benefits. QuickBooks Online provides user-friendly options for these adjustments, allowing businesses to customize their payroll settings efficiently. It is critical to consider the implications of these changes, including potential impacts on employee paychecks, tax filings, and financial reporting.

I assume I’ll have to go back and recreate the paychecks for the employees using the correct acct, and that rather than DD, I’ll select paper check. I’m talking about 31 transactions ranging from March to June, so not too many, but still… Upon completion, the revised liabilities are accurately entered into QuickBooks, with careful attention to detail to maintain accurate financial reporting and compliance with tax regulations. The accrual method posts payroll liabilities and expenses in the same period.

Once done, you can run the payroll summary report again to verify the changes. Thank you for getting back to us and providing detailed information (with screenshots) regarding your payroll liabilities issue, @bbxrider. You have to verify the next liability amount by confirming your adjustment was added to the payroll. Below are the steps that are used to enter the credit in QuickBooks Online Payroll Essentials. You should manually amend Payroll Liabilities in QuickBooks Online for various reasons, such as Payroll Credits, Penalty & Interest, Late Filings, and many more. Other times, processing Payroll Liabilities manually is simply required.

After printing your reports, it’s a good idea to download the transactions from QuickBooks into an Excel spreadsheet. It makes it easier to organize the transactions so it’s clear which amounts cleared and which did not. Tara Kimball is a former accounting professional with more than 10 years of experience in corporate finance and small business accounting. She has also worked in desktop support and network management. Health insurance premiums, retirement plan contributions, and other benefit programs are funded through payroll withholding.

I’ll be on the lookout for your reply if you need further help with your payroll liability. I reviewed your original post and based on the conversation so far, I can see that my colleagueLilyCprovided you with the right solution. Although just to clarify, it’s not always necessary to have a credit with the agency to adjust your payroll liabilities. You can adjust more than one liability at a time during one liability adjustment transaction by selecting the payroll items in the payroll item column provided. You can use only one effective date for a liability adjustment.