How to Do Accounting for Small Business: Basics of Accounting

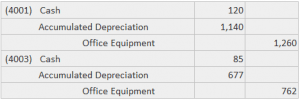

We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the banking methodology for the ratings below. The last step of the accounting cycle is to prepare a post-closing trial balance to test the equality of the debits and credit amounts after the closing entries are made. This trial balance contains real accounts only as the temporary accounts are closed this accounting cycle. A trial balance is prepared to test if the total debits equal total credits.

Novo Business Checking

But the bank may convert the account into another checking product if you make more than $40,000 in cash deposits during a statement cycle. The account is meant for businesses that have less than $10 million in annual sales. Just as businesses are different, so, too, are the features that each business owner will require in a business checking account. Most banks don’t require a credit check to open a business checking account. That means even if you have bad credit, you should still be able to get a business checking account.

Earn up to $300

You’ve opened a business checking account, chosen your accounting method, and decided how you’re going to keep your books. Being able to grow or start an LLC may require having access to additional features like merchant services, invoicing tools and payment platforms. To compare accounts, think about the services you need now, as well as those you may need in the accounting equation explained future. When you start a business, open a separate business bank account that will keep your business finances separate from your personal ones. When rating banks and banking services, we use a 53-point rubric that looks at rates and fees, services, eligibility requirements, application, sales and advertising transparency, customer service, and user reviews.

What Is A Business Checking Account?

The classic phrase to explain the advantage of franchising is that it feels like “being in business for yourself, but not by yourself.” A survey from Shopify found that the average online small business owner spends about $40,000 in the first year. Ideally, you can start making sales and earning revenue quickly so you can cover those costs. But $40,000 is a reasonable average estimate for the cost of starting an online small business. But if you want to make a serious impact with attractive inventory that people want to buy, and with powerful search engine marketing that can drive traffic to your site, you need to spend some cash. There’s not an easy answer for how much money it takes to start a small business.

Best for welcome bonus

This is irrespective of whether you received or paid cash for the product or service. You must use a double-entry accounting system and record two entries for every transaction. Under the cash-basis method of accounting, you record income and expenses when cash transactions are done. For example, you record revenue for a product only when the customer pays you for the product.

With a business checking account, you likely will be handling a wider variety of transactions and the quality of your record-keeping matters more. We chose Relay because its fee-free digital account lets business owners seamlessly integrate with accounting and payment software and create sub-accounts to separate their funds. Relay offers both a free business checking account and a paid account with more integrations. KeyBank Business Reward Checking has a $25 minimum opening deposit requirement and comes with a $25 monthly fee, which is waived for the first two months. After that, the fee can be waived with an average daily balance of at least $7,500 in this account or a combined average daily balance of $20,000 across eligible business deposit and credit accounts. It is also waived for customers with Key Merchant Services subscriptions.

Business bank accounts function as a hub for all financial transactions related to a company’s operations. They’re established under a business’s legal name, so business finances stay separate from the personal finances of the owner or owners. Small business owners need a business account that offers the right services at a cost that doesn’t break the bank.

And generally, no matter the plan or price, accounting software is more reliable than by-hand spreadsheet accounting. Using spreadsheet software is the cheapest accounting option (especially if you use a completely free software, like Google Sheets). The PNC Bank Treasury Enterprise Plan is a banking package designed for small and medium-sized businesses with higher transaction volumes.

The Plus plan costs $30/month, and the Premier plan costs $95/month, but both places can waive these fees if you meet the criteria. Similarly, banks that offer merchant services tend to have caps on how many transactions you can process. If you process many transactions each day, you’ll want a merchant services account that can handle a large volume of transactions. You can find many different types of financial institutions for your small business banking needs.

- The right accounts give you a way to deposit, hold, and spend money, and some account types enable you to accept credit and debit card payments.

- The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

- The account allows for easy integration with business tools like Stripe, Shopify, QuickBooks and Zero, which makes it easier for business owners to streamline business operations.

- Rho really stands out with its lack of monthly fees, ACH fees, overdraft fees, or wire transfer fees.

Business bank accounts don’t usually come in specific “types” for certain kinds of businesses. There isn’t a common, designated account type for LLCs, for example (although some banks may offer “LLC bank accounts”). But different business bank accounts come with different features and restrictions, making some better for certain businesses than https://www.business-accounting.net/all-you-need-to-know-about-zero-depreciation-auto-insurance/ others. Business bank accounts are used only for business finances, not personal finances. But you’ll need to provide both personal and business information to open a business bank account. The Silver Business Checking Package has no monthly maintenance fees and allows for up to 125 transactions, which is adequate for many small businesses.

We like that Relay lets business owners open up to 20 checking accounts, issue up to 50 virtual debit cards to employees and connect accounting, payroll and receipt management software. Plus, Relay’s paid checking account—Relay Pro—offers even more integrations and a few waived service fees. The First Internet Bank Do More Business Checking account is an unflashy interest-bearing checking account with no minimum deposit or balance requirements and no monthly maintenance fees.

Enjoy zero annual or late fees, 1.5% cashback on all business purchases, and a flexible credit limit with the Stripe Corporate Card. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. Brittney started her writing career in the world of science, putting her physics degree to good use. Her journey into finance started with building her personal credit, but soon grew into a borderline obsession with credit cards and travel rewards.

Capital One recommends their Basic Business Checking account for small businesses. PayPal for Business is a business payment solution designed for businesses of all sizes, especially small businesses. This account from Chase Business is designed with small businesses in mind. Here are some of the top options to choose https://www.simple-accounting.org/ from, along with what fees to look out for and what perks they come with. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Can manually enter time in Essentials plan and higher; automatic time tracking costs extra.

We chose KeyBank Business Reward Checking because of its high cash deposit limit and low over-limit fees, its unlimited incoming wire transfers and its affordable merchant services. The account provides 500 free transactions and up to $5,000 in cash deposits per statement cycle. After reaching these maximums, you will pay $0.50 for each transaction and $0.30 per $100 deposited.