Memorizing Deposit Transactions that include Undeposited Funds

This account can typically be found in your Chart of Accounts or in the Banking section of your QuickBooks Online account. Whether you are new to QuickBooks Online or looking to optimize your bookkeeping workflow, this guide will equip you with the knowledge and tools to effectively manage and clear undeposited funds. It shouldn’t be showing as undeposited funds since it’s deposited and reconciled.

Sales receipts for payments you process outside of QuickBooks

Both accounts receivable and undeposited funds accounts were used but came out with a $0.00 balance in the end. If this process is not handled correctly you run the risk of overstating income. As an example if you create the invoice and then deposit a check directly into the bank register without receiving the payment against the invoice you will overstate income. The reason is you have recorded the income when you created the invoice.

- In some cases, you may encounter a situation where some payments remain uncleared or unmatched.

- If you added a payment to a deposit by mistake, you can remove that payment easily by clicking on the deposit or amount field in the deposit entry line in the Deposit Detail report.

- To sum up, once you get the hang of these undeposited funds, accounting and bookkeeping become easier than ever.

- With this, ensure that your bank account is linked to QuickBooks for payments to be downloaded automatically.

- For more detailed instructions, head to our tutorial on how to receive payments in QuickBooks Online.

Step 3: Review and Manage Deposits

When you follow the workflow to receive payment for an invoice, QuickBooks automatically puts them into Undeposited Funds. Learn about the Undeposited Funds account and how to combine multiple payments together in QuickBooks. Please let us know book value per share bvps definition if you need further assistance managing bank deposits or any other QuickBooks issues. If there’s anything else that I can help you with aside from managing your bank transactions or any banking-related, please let me know in the comments below.

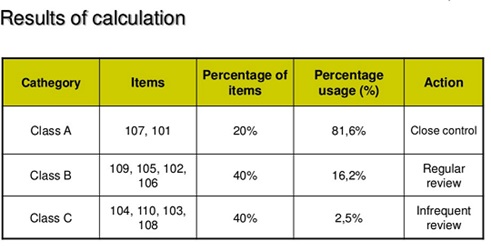

The Quality Assurance Process: The Roles And Responsibilities

The option to create a memorized invoice payment and deposit with customer payment isn’t available in QuickBooks Desktop (QBDT). Memorizing a deposit with customer payment will result in an error message, @safoglio. I understand that you’re looking to clear out or deposit undeposited funds. Let me share some insights on how to clear it out and how undeposited funds work in QuickBooks Online.

My problem is that the invoices are automatically matched and marked “Paid” through the Quickbooks Online Payment process. For example, if you need to provide additional information or notes about the deposit, like the source of the funds, you can add those details in the memo or notes section of the transaction. It’s a good idea to check your Undeposited Funds account to clear out any payments waiting to be deposited. Use it to hold all payments you need to combine and group together.

Use the Receive payment form when your customer pays you for an invoice and the Sales receipt form when you receive immediate payments. Some accountants or bookkeepers who don’t understand the full functionality of QuickBooks Online might try to fix incorrect balances in the Undeposited Funds account with a journal entry. Although this will remedy the incorrect account balance on the balance sheet, it will not clear the undeposited transactions from the Bank Deposit screen. Make sure you select Undeposited Funds from the “Deposit To” drop-down menu, then save the transaction. If your bank records a single payment as its own deposit, you don’t need to combine it with others in QuickBooks.

This involves careful validation of each payment against the deposit verification to ensure accuracy and completeness. It is crucial to reconcile the transactions in QuickBooks with the actual deposits in the bank statement for precise financial records. These funds serve as a temporary holding account in QuickBooks, allowing businesses to track and manage their received payments before the actual bank deposit is made. Before you begin clearing undeposited funds in QuickBooks Online, it’s important to have a clear understanding of how this feature works.

By eliminating the need for manual data entry, QuickBooks bank feeds significantly reduce the risk of errors and ensure that financial records are always up-to-date. Promptly reviewing and applying customer payments in QuickBooks is crucial for maintaining accurate cash flow and financial records, reducing the risk of undeposited funds. Once you access the Undeposited Funds account, ensure that all payments received are correctly recorded and matched with corresponding invoices or sales receipts.

By thoroughly reviewing and organizing your transactions in the undeposited funds account, you ensure that you have an accurate and complete record of the payments you intend to clear. This sets the stage for a smooth and accurate clearing process as you move on to the next steps. Once you’re in the undeposited funds account, you will see a list of https://www.business-accounting.net/prepaid-insurance/ the payments that have been recorded but not yet deposited. Make sure that all the payments are from customers and that they correspond to actual invoices or sales receipts. When you receive a payment from a customer, QuickBooks Online automatically assigns it to the undeposited funds account instead of directly depositing it into your bank account.

I don’t want to re-deposit and have duplicate deposits in there. This post will help you understand the purpose of an undeposited funds account, how to clear it, and how to https://www.intuit-payroll.org/ avoid having payments automatically posted to this account. We make it a point to reconcile the balance sheet accounts every month when we are doing month-end closings.

We offer our toolkit of financial intelligence that will be your greatest asset for business growth. I appreciate your effort in matching all your transactions just to fix your issue about your undeposited bank. I’m more than happy to help you out again if you have more questions about managing your Undeposited Funds account.

I can help you move those payments from your undeposited funds account, @FlexMgt. You can add payments to your deposit slip in a similar fashion. Any undeposited payments sitting in the Undeposited Funds account will appear in the list of payments without a checkmark.