5 Types of Financial Statements The Completed Set and Beginner Guide

Finally, without properly prepared financial statements, filing your taxes can be a nightmare. Not only do financial statements tell you how much income to report, but they also give you an overview of the expenses you’ve incurred—some of which can be written off as small business tax deductions. The cash flow statement then takes net income and adjusts it for any non-cash expenses. Then cash inflows and outflows are calculated using changes in the balance sheet.

Submit to get your retirement-readiness report.

Investors can also see how well a company’s management is controlling expenses to determine whether a company’s efforts in reducing the cost of sales might boost profits over time. Expenses that are linked to secondary activities include interest paid on loans or debt. Primary expenses are incurred during the process of earning revenue from the primary activity of the business. Expenses include the cost what are debits and credits of goods sold (COGS), selling, general and administrative expenses (SG&A), depreciation or amortization, and research and development (R&D). Other income could include gains from the sale of long-term assets such as land, vehicles, or a subsidiary. Net income is either retained by the firm for growth or paid out as dividends to the firm’s owners and investors, depending on the company’s dividend policy.

Regulatory Framework and Standards

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Accountants must maintain the confidentiality of a company’s financial information https://www.accountingcoaching.online/abc-technique/ and only disclose it to authorized parties. They should not use confidential information for personal gain or share it with unauthorized individuals. There are several types of audits, including internal audits, external audits, and regulatory audits.

- Balances of current liabilities like accounts payable and long-term liabilities like bonds appear here.

- Even when analyzing audited financial statements, there is a level of trust that users must place in the validity of the report and the figures being shown.

- That’s why you’ll often notice some distinctions between the financial statements of American and European firms.

- Add an account statement column to your COA to record which statement you’ll be using for each account–cash flow, balance sheet, or income statement.

- This information is useful for analyzing how much money is being retained by the company for future growth as opposed to being distributed externally.

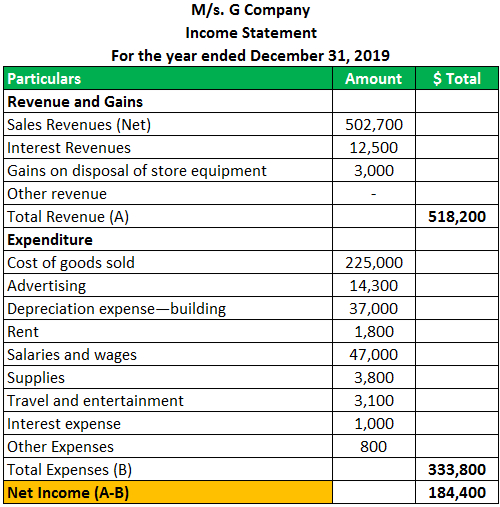

The income statement

In general, however, the following steps are followed to create a financial model. These three core statements are intricately linked to each other and this guide will explain how they all fit together. By following the steps below, you’ll be able to connect the three statements on your own. Subtract gains related to financing, like interest received, and add back financing expenses or losses, like interest paid.

As you know by now, the income statement breaks down all of your company’s revenues and expenses. You need your income statement first because it gives you the necessary information to generate other financial statements. The income statement also shows the business’s expenses for the time period, including its primary expenses, expenses from secondary activities, and, finally, losses from any activity, including current depreciation. Financial statement preparation involves creating accurate and reliable financial documents that reflect a company’s financial position and performance. This method allows for easy comparison of financial statements across different companies or time periods. Horizontal analysis, on the other hand, involves comparing financial statement items across multiple periods to identify changes and trends in a company’s financial performance.

Create business account names

The IASB is an independent, international organization responsible for developing and promoting the adoption of IFRS worldwide. It aims to create a single set of global accounting standards that enhance transparency, comparability, and efficiency in financial reporting. Comparability refers to the ability to analyze and compare financial information across different companies or time periods. It enables stakeholders to evaluate the relative financial performance of different companies and make informed decisions.

According to the agreement, interest is due every 12 months and the rate is 4% per annum. She taught Accounting, Management, Marketing and Business Law at WV Business College and Belmont College and holds a BA and an MAED in Education and Training. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

An original or historical cost of accounts can help you prepare financial statements. Typically, you record prices and assets you purchase at different times at the original cost. Yes, you can use QuickBooks financial reporting software to help generate your financial and accounting reports seamlessly. Now, after you finish the income statement, you should be able to draft the statement of change in equity, followed by the balance sheet, and finally, you can draft the statement of cash flow. The cash flow statement is one of the financial statements that show the movement (cash inflow and outflow) of the entity’s cash during the period. This statement helps users understand how is the cash movement in the entity.

The cash flow statement contains three sections that report on the various activities for which a company uses its cash. They must provide unbiased, accurate, and complete information in the financial statements to protect the interests of all stakeholders. Conservatism is an accounting principle that requires accountants to exercise caution when making judgments and estimates. It suggests that, when in doubt, accountants should choose the option that will least overstate assets and income and least understate liabilities and expenses. If a company has subsidiaries or other related entities, it may need to prepare consolidated financial statements. QuickBooks Online automatically sets up a chart of accounts for you based on your business entity with the option to customise it as needed.

Expenses are recorded in a different direction from revenues in terms of the accounting entry. Yet, they normally report the different line between the cost of goods https://www.accountingcoaching.online/ sold and general and administrative expenses. If you want to pursue a career in Financial Analysis, your practical skills are what set you apart from the crowd.